The research studies the relation between oil revenues and budget structure in oil dependent country – Azerbaijan. In the paper I will analyze Norwegian, Russian model of oil revenue management. The study shows how oil prices influenced these oil-exporting countries’ economies. I will try to analyze the changes in budget inputs and outputs of the state budget depending on the declining oil prices in the world market. In this study three years – 2014, 2015 and 2016 state budget revenues and expenditures will be compared to find the effects of oil prices. At the end, the paper will suggest recommendations how to deal with crisis situation in Azerbaijan.

Introduction

A state budget is one of the main government documents presents the government’s revenues and expenditures for a fiscal year. A state budget is accepted by the legislative body, approved by the president and presented by the Finance Minister to the public. There are two basic elements in any state budget: revenues and expenses. Generally, taxes generate primary part of national revenues; expenses include public spending such as health, education, social aids, pensions and investment expenditures to economy, infrastructure etc. The state budget and public finance have a crucial role in economy such as efficient allocation of resources, distribution of income, and macroeconomic stabilization. In every country there are separate government department, ministry or office which provides financial functions for the state. For example, in the USA Finance and Development Department under Secretary for economic growth, energy and the environment is responsible executive body for the public finance and budgeting. [1] The department has three offices Development Finance, Investment Affairs, and Monetary Affairs which are responsible for the economic development of the country through global economic stability.

In Azerbaijan the Ministry of Finance is the central governmental body organizing and managing state financial policy and state finance; preparing and organizing drafts of state and consolidated budgets; ensuring cash execution of state budget; ensuring the state regulation over insurance activity, public debt management, accounting and control over the use of state budget funds, the production, processing and circulations of precious metals and precious stones.[2] The first Ministry of Finance was established 1918 with the declaration of the Azerbaijan Democratic Republic. The current Statue of the Ministry was approved by decree of the president in February 9, 2009. The Ministry’s structure and statutes of other agencies and services such as State Treasury Agency, Public Debt Management Agency, State Financial Control Service, State Insurance Control Service and State Service for Control on Precious Metals and Stones which are included in the structure of the Ministry by were also approved the same decree. [3]

The issues related to state budget of Azerbaijan are regulated by the Constitution of the Republic of Azerbaijan, the law on “Budget system”, “Tax” code and other related legal – regulatory documents. The law on “Budget system” defines the main principles of budget formation and inter-budgetary relations, budget constitution, approval, execution and supervision of their formation, application of legal and economic bases, establishment and operation of extra-budgetary funds and rules of their utilization.[4] According to the law, “budget is a main financial document for accumulation and utilization of cash funds to fulfill the functions of the state and municipalities through the relevant authorities and self-government bodies”.

The State Budget of the Republic of Azerbaijan aims to collect and realize the financial resources in accordance to the legislation. Financial resources are used for the implementation of state functions and addressing economic, social and other strategic programs and problems of the country. The source of budget revenues are taxes, non-tax revenues, other payments and earnings. Expenditures are allocations from the State Budgets in accordance with the budget classification, to meet the demand stipulated in the legislation. [5] Budgeting process consists of four stages: compiling of draft budget, approving state budget, implementation of budget and monitoring of implementation. [6]

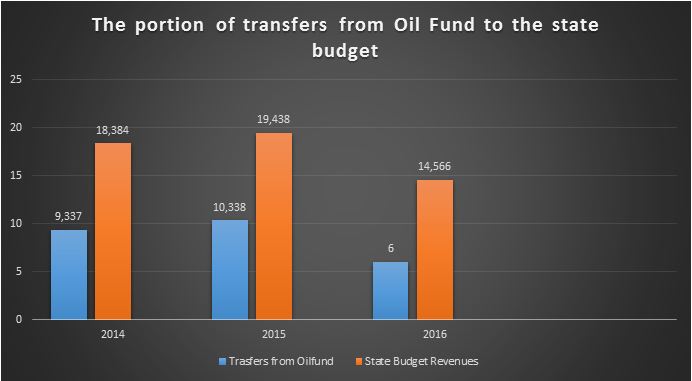

A common budget classification is applied in Azerbaijan. Budget system includes budget organizations and extra budgetary state funds such as “Reserve Fund of the President”, “state budget reserve fund” and the “State Oil Fund”. As Azerbaijani economy is mostly dependent on oil sector State Oil Fund’s revenues are transferred to the state budget and almost one in third part of state budget is formed by these revenues. Later I will show the portion of different sources of state budget revenues for 2014, 205 and 2016 in detail and analyze the relation between oil revenues and expenditures.

Literature review

Davis, Ossowski and Fedelino in their book (2013) discuss the difficulties of addressing the challenges of being oil dependence. They note that, sometimes it is disappointing; many countries which have natural resources suffer from poverty, instable economy and volatility of oil prices. Volatility makes significant fluctuations in fiscal revenues. There is post-oil period as oil is an exhaustible resource. Oil producing countries not only should plan oil period, but also post-oil period which means to save money for future generations and to invest properly these revenues. Taking into account such problem many oil-exporting countries established oil funds which aim to stabilize economy, development and redistribute oil revenues effectively and save money for future generations. Here I will analyze Norway and Russian models of oil revenue management and funds which manage oil revenues. I chose these two because they are also oil-exporting countries like Azerbaijan. I will show how the declining oil prices effected funds and revenues; how countries deal with the problem which is the result of oil prices.

Norway is one of the richest and developed countries in the world. Oil revenues significantly support the overall economy in Norway. For the purpose of managing oil revenues effectively Norway government has established The State Pension Fund in 1990 (the name was The Petroleum Fund of Norway during 1990-2006). The fund is united to the state budget. It is managed by Norges Bank Investment Management (NBIM) which is a division of Central Bank of Norway under the Ministry of Finance. According to budgetary rule of Norway, only 4 percent of the fund value can be used by the government per a fiscal year. [7] The rule aims to use oil revenues gradually and save money for future generations. The Norwegian model of management contains a long term planning. The fund was the largest pension fund in the world as for June, 2011 and the largest stock owner in Europe with 1.78 percent of European stocks. The total value of the fund was Kroner 5.534 trillion ($857.1 billion).[8] The fund is allowed to invest in international stock market and real estate as well. In 2015 Norwegian government transferred 3 percent of oil revenues which made up 19.15 billion USD to the national budget in 2015.[9] According to official website of the fund, market value increased to 7.019 trillion Kroner in the second half of 2015. Equity, fixed-income and real estate investments make up market value of the fund. The graph below shows the portion of each investments in the market value of the fund.

The fund revenues mostly generated by petroleum sector and return on assets. For sure declining oil prices effect Norway as other oil-exporting countries through different ways. The fund reports that an return for every year was 5.5 percent from the beginning of 1998 till the second half of 2015.. After management costs and inflation, the annual return was -0.9 percent in 2015.[10] Revenues from petroleum sector is expected to decrease over the next decades. The share of oil and gas sector on GDP of Norway is 20 per cent.[11]

Another economy that suffers from falling oil price is Russia. As one of the largest oil and gas producing country Russia shares a significant portion of oil market in the world. Russia has established “Reserve Fund” in 2004 where oil revenues are gathered from production and export of oil and natural gas. The share of these revenues is 52% in the federal budget of Russia. The Fund value was 4.67 trillion rubles ($70.51 billion) for October, 2015.[12] As for November, 2015 Russian finance minister announced that 260 billion rubles ($4.06 billion) was used from the Reserve Fund budget to finance the federal budget deficit. He stated: “Reserve Fund can be entirely drained in 2016 if oil prices stay at their current level”. [13]

The share of Reserve Fund in gross domestic product should be 6.7 percent in the beginning of 2015, however this number is expected to decrease to 1.3 percent by the end of 2016. [14] Tass reported that budget deficit would be $34.9 billion in Russia in 2016. According to the same article, low level of oil prices and dollar’s current exchange rate will harm 900 bln rubles ($14.1 bln) the state budget of Russian Federation Russian in 2016. [15]

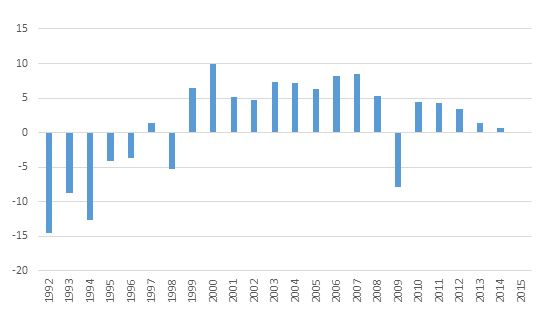

I analyzed Russian GDP growth from 1991 till 2015 with the World Bank Development Indicators Data. The graph below shows how GDP growth changed through the years. If we look at 2014 data, we can see the growth rate was the least after the financial crisis (2007-2009) with 0.64%.[16]

The impact of declining oil prices on state budget of Azerbaijan

As I mentioned above, Azerbaijan is oil dependent country. Azerbaijan signed the “Contract of the Century” which allowed to Azerbaijan to maximize revenues through oil sale in the future. It was a new period in the development of oil industry as well as overall economy. As duties of state are to provide society with social benefits, distribute income properly and spend revenues effectively and more importantly to save oil revenues for future generations, Azerbaijan established “State Oil Fund of the Republic of Azerbaijan” in 1999. SOFAZ’s mission is “to transform depletable hydrocarbon reserves into financial assets generating perpetual income for current and future generations, to finance strategically important infrastructure and social projects of national scale, to ensure the representation of the country in international agreements on joint exploration of natural resources”[17]. First assets in the amount of 270.9 million USD were transferred to the SOFAZ’s account in the Central Bank of AR. Throughout the following years revenues and assets of fund increased and assets exceeded 2 billion USD in 2006 and 30 billion USD in 2012. Every year Azerbaijan implemented educational, social programs through the SOFAZ’s transfers to the budget. Approximately 30% of State budget is formulated by the oil revenues. According to Extractive Industries Transparency Initiative report, 79 percent of Azerbaijan state revenues comes from oil and oil industries[18], so the declining oil price significantly affects state budget. The share of oil sector in GDP was 34 percent with 20372.5 million AZN in 2015. [19] After 2010 the average price for crude oil was around 110 USD until 2014. Then oil price unexpectedly decreased by 44% and became 66 USD in August 2014[20] and the falling oil prices continues till today. As for December, 2015 the Brent crude oil is sold for 38 USD in the world market[21]. The state budget for 2016 is 14.566 billion AZN which is less 5 billion and 4 billion in comparison with 2015 and 2014 budgets respectively. The state budget for 2016 is the lowest budget of last five years. The declining amount of revenues made government to decrease expenditures on different sectors. Therefore, the expenditures are approved 16.264 billion AZN which were 21.100 billion AZN in 2015 and 20.063 billion AZN 2014. Transfer from Oil fund to the state budget decreased by around 40% from 10 billion AZN to 6 billion AZN.

When we analyze the budget of the State Oil fund we see that the revenues decreased not only by the production and sale of oil, but also acreage fees paid by foreign investors for use of the contract areas for the development of hydrocarbon resources from 2014 to 2015. The overall revenues of the fund in 2014 was 12. 731 016 billion AZN in which 12.319 846 billion AZN comes from the sales of the Republic of Azerbaijan’s share of hydrocarbons, 1.661 billion AZN from acreage fees, 387.204 million AZN from SOFAZ’s asset management .[22] The difference between revenues (13.731016 bln) and expenditures (10.117207 bln) of the fund budget was 2.613 billion AZN in 2014. Total revenues of budget were 2.484 405 billion less; sales revenues were 2.578 671 billion less and acreage fees were 93 million less in 2015 in comparison with 2014[23]. The fund’s budget for 2016 is not approved yet, however we can see from the analysis of the projected consolidated budget that earnings of the fund will be around 6.711 billion AZN which is 34.5% less than last year’s revenues. The expenditures of the fund is 8.200 billion AZN or 33.4% less than last year.[24] As a natural result of decreasing budget of the fund, the amount of money which is transferred to the state budget also declined. 73.2% of the fund’s revenues (6.000 billion) will be transferred to the state budget in 2016. The chart shows overall state budget revenues and transfers from the fund to the budget.

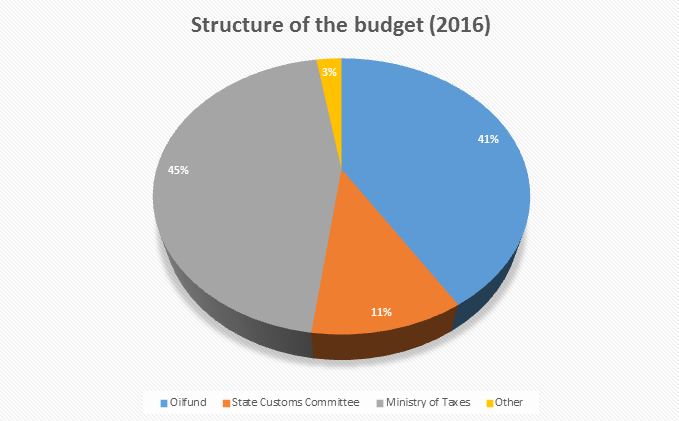

The other sources of the state budget revenues are taxes gathered by Ministry of Taxes and State Customs Committee. Ministry of Taxes collects income and profit tax of entities, land tax, property tax, VAT, excise taxes, mining tax, simplified tax etc., while State Customs Committee is responsible for collecting VAT for imported goods into Azerbaijan, road taxes, customs duty etc.

The pie-chart indicates the structure of state budget of 2016. Here we can find the percentage of revenues generated by Ministry of Taxes, State Customs Committee, State Oil fund’s transfers and other sources.

As the declining oil prices slowed down economy and economic growth in the world, the size of business, imported and exported goods wend down as well. On the other hand, 65.3% of budget revenues (12.688 billion AZN) are generated from oil sector, remaining comes from non-oil sector in 2015[25]. The direct taxes and other payments from non-oil sector (income tax of non-oil sectors’ workers, profit taxes of non-oil sector legal entities etc.) were 6.702 billion AZN. The decree of the president on the utilization of the law on “State Budget of the Republic of Azerbaijan in 2014” shows that, only 4.300 billion AZN out of 7.102 billion AZN taxes belongs to non-oil sector. [26] All mentioned factors indicate how much oil and oil products are important in Azerbaijani economy and the falling oil prices may affect the economy in different ways. The table below shows the changes in different taxes through three years’ budget:

(All numbers are in thousands of AZN)

| Taxes / years | 2014 | 2015 | 2016 |

| Income tax of individual | 882 000,0 | 982 000,0 | 957 000,0 |

| Profit tax of legal entities | 2 217 000,0 | 2 211 000,0 | 1 806 600,0 |

| Land taxes of legal entities | 48 000,0 | 48 000,0 | 50 000,0 |

| Property taxes of legal entities | 132 000,0 | 148 000,0 | 174 200,0 |

| VAT | 3 209 000,0 | 3 456 000,0 | 3 336 000,0 |

| VAT of imported goods | 1 070 000,0 | 1 104 000,0 | 1 120 000,0 |

| Simplified taxes | 130 000,0 | 145 000,0 | 280 000,0 |

| Excise | 874 000, 0 | 684 000,0 | 637 000,0 |

| Excise of imported goods | 90 000, 0 | 120 000,0 | 105 000,0 |

| Customs duties | 330 000,0 | 348 400,0 | 348 000, 0 |

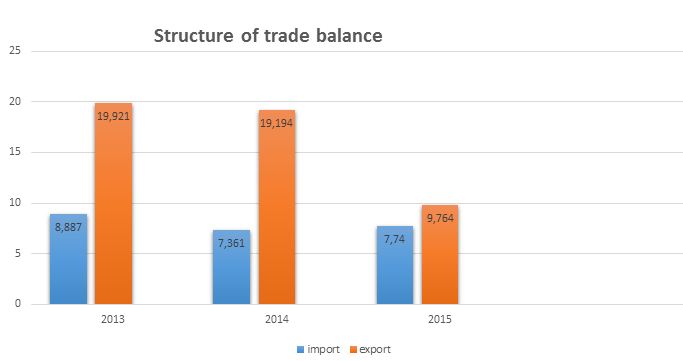

As it is visible from the table most of taxes’ revenues increased from 2014 to 2015, while many all of them is projected to be less than previous year in 2016 budget plan. Referring to decreased profit taxes of legal entities, VAT we can understand the significance of oil sector in the economy. As mentioned before, the share of oil sector in GDP is 34% which explains the reasons for the declining taxes revenues: most of entities; companies somehow are related to oil and oil sector. Moreover, the reports given by the State Customs Committee on “Customs Statistics of Foreign Trade” in 2013, 2014 and 2015 show that the size of overall trade operations was 28.799 billion, 26.557 billion and 17.206 billion USD respectively during first 10 months. [27] The reports reveal that trade size decreased by 7.78% in 2014 in comparison with 2013 and 35.21% in 2015 than 2014. The share of import and export were as following during three years: (All numbers are shown in billion USD)

Another report by the State Customs Committee shows that Azerbaijan exports mostly oil and oil products, so that the share of exported oil and oil products in trade balance was 17.848 billion USD in 2013. This number felt to 17.478 billion USD in 2014. Before analyzing the share of oil and oil products in the trade balance of 2015, a note should be mentioned. After the second half of 2014 the oil prices went down steadily and in February 2015 the national currency of Azerbaijan – manat was devaluated by 34% which means the value of manat weakened against the value of dollar. Before 1 dollar equaled to 0.78 AZN, after the devaluation it became around 1.05 AZN. So in the trade balance of 2015 decreasing share of oil and oil products is not only effected by the decreasing oil prices in the world market and decreasing production level, but also dollar-manat exchange rate. In the first ten months of this year oil and oil products compiled 8,234 billion USD of exported goods. Now I will change these numbers to AZN according to devaluation for being able to compare more precisely.

| Years/Currencies | USD | AZN |

| 2013 | 17.848 | 13.921 |

| 2014 | 17.478 | 13.632 |

| 2015 | 8.234 | 8.645 |

(Money value of oil and oil products in export of Azerbaijan)

The analysis of the table shows that the decreased money value of exported oil and its products is also effected by the devaluation and the exchange rate of manat to dollar. If we compare the shares of exported goods according to dollar, we can see that the share went down by 52% during last year, while comparison of manat shares of exported goods gives another conclusion which is 46% decline from 2014 to 2015.

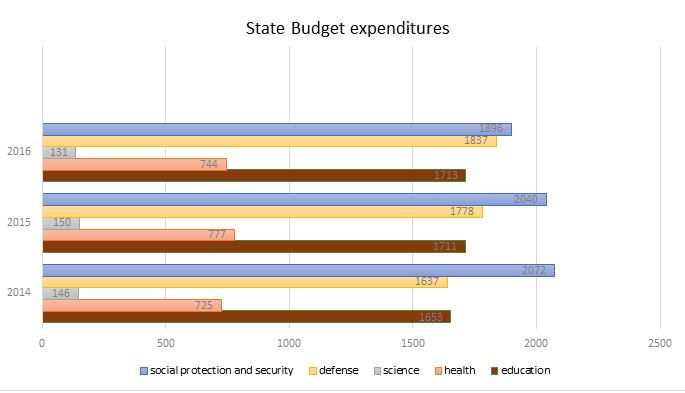

As for the budget expenditures I will compare the most important ones: education, social protection and security, health, science and defense during three years. The government usually allocate the most of public spending to these sectors.

(Numbers are in million, AZN)

The graph indicates that expenses were decreased considerably in 2016 budget except education and defense expenditures. The portion of education expense is 2.4% more than last year. Defense expenditures for 2016 increased around 3% in comparison with 2014. The president of the country and the minister of finance mentioned that the next year will be difficult, so state budget should be economized and the expenses should be decreased. Minister of Finance said that Azerbaijan will apply fiscal prudence policy in the next years. The minister also highlighted that the tax and customs allowance will be considered again, the numbers of goods which get tax discounts will be decreased and tax procedures will be simplified in order to stimulate business and entrepreneurship which allow to collect more tax in the future. [28]

Other important indicators of the budget are state debt and budget deficit. The highest verge of state budget deficit is approved as 1698000.0, 1662000.0 and 1698000.0 thousand of AZN in 2013, 2014 and 2015 respectively. As a funding of deficit is used “transfers from privatization, revenues from investment securities, foreign grants and the rest of united treasure account of the state budget for January 1, 2014” (depending on a year it changes).[29]

The highest limit of internal and external state debts are approved as following:

(All numbers are in thousand, AZN)

| Years/debts | Internal debt | External debt |

| 2014 | 1200000,0 | 2000000,0 |

| 2015 | 1500000,0 | 1500000,0 |

| 2016 | 2500000,0 | 1500000,0 |

As for October, 2015 the amount of external debt of Azerbaijan was 6.730.9 million USD (7.054.0 million AZN), the ratio of external debt to GDP was 12.4%. The debt includes direct obligations of the state and contingent liabilities emanating from sovereign guarantees. [30]

Lastly, I want to analyze how the decreased oil prices influenced people and their living conditions by need criteria and subsistence minimum. Need criteria remained unchanged at 105 AZN, subsistence minimum increased by 5 manat and is approved as 136 AZN for 2016. The calculation of need criteria according to officially given inflation rate which is around 4 % [31] shows that the criteria is decreased indeed. Considering the 4% inflation need criteria should be at least 109.2 AZN in which it would be equal last year’s indicator. The subsistence minimum is equal to last year’s indicator according to official inflation rate. However these numbers are indeed less than 2015’s indicator considering the devaluation fact. Average consumption cost per person was 234.9 AZN in 2014 in Azerbaijan. 40.7% (95.7 AZN) of this cost belongs to only food and products[32] which is in the second place in imported goods list after cars, mechanisms and electronic equipment. [33] 105 AZN was 134 USD before the devaluation, now this amount equals to 100 USD. In order to keep need criteria as same as last year it should be adjusted as 140.7 AZN at least. The situation with subsistence minimum is even worse. The last year’s (2015) indicator was 131 AZN (167 USD) was 38 USD higher than this year’s (2016) indicator which is 136 AZN (130 USD) [34]. So actually people are not able to buy the same amount of goods with the “increased” 5 manat.

Conclusion and recommendations

The analysis of the state and consolidated budget showed that the revenues decreased considerable. The decreasing oil prices affected negatively not only the revenues generated from direct sale of oil and oil products but also profit taxes, value added taxes which are related to oil sector. As the share of oil sector is high in GDP overall economy were influenced adversely. The logical flow of decreasing state revenues is to decrease expenditures as well which Azerbaijani government apply this policy. Although government tries to increase the revenues through other taxes such as land, road, simplified, it is hard to reach the same level of budget revenues without high oil prices in next years. The ministry of finance prepared three scenario considering changing oil prices for 2016-2019: optimistic – oil price equals to 60$, base – price equals to 50$ and pessimistic scenario – price equals to 40$. The decreasing budget revenues do not allow government to provide people with the equal amount of wages, aids, pension to real rate of inflation.

The government should diversify the economy in order to decrease negative impact of declining oil prices on the state budget. By diversifying the economy government can compensate decreasing oil revenues with taxes and decrease the oil dependency of overall economy. I would suggest to improve agricultural sector immediately to ensure food security, lessen dependence on imported food products and decrease the loss formed due to exchange rate when Azerbaijan buy cereal, wheat, oat and grain from foreign countries. Agricultural products have a huge share in imported goods, therefore the improvement of this sector will matter in terms of achieving positive trade balance. As Azerbaijan historically was agricultural country and agriculture compounds 6 percent of GDP; 40% of household income comes from agriculture and it provides 39% employment in rural areas,[35] it would not be difficult to improve this sector in a short period of time. The conditions (having 9 different climate types and different types of arable lands) are also fruitful and suitable for agriculture in Azerbaijan. Another advantage and importance of agriculture is to decrease poverty reduction as it is a sector where many people can be employed.

Another recommendation is to support and stimulate entrepreneurship in the country through privileged loans and reforms on customs and taxes. Although Azerbaijan has already begun to make reforms, there is no real results and actions. The control over the implementation of reforms should be strengthened. Additionally, Azerbaijan may become a member of World Trade Organization to accelerate and ease the business process, attract investment into country etc. All these factors will increase the budget revenues through profit and income taxes, VAT etc.

For sure Azerbaijan should continue to economize on the state budget and spend less money on unnecessary events such as Formula 1, European Games, Islamic Games etc. In my opinion, current situation requires to invest money on economic investments rather reputation of the country.

BY: Aygun Gurbanli

Bibliography

- Azerbaijani State Budget in 2016 Perspectives and Challenges. 2015.

- Customs Statistics of Foreign Trade. 2015.

- Customs Statistics of Foreign Trade. 2014

- Davis JM, Ossowski R, Fedelino A, International Monetary Fund. Fiscal Policy Formulation and Implementation in Oil-Producing Countries. Washington, D.C: International Monetary Fund; 2003.

- El-Gamal M. A., Jaffe A. M. Oil, dollars, debt, and crises: the global curse of black gold. – Cambridge University Press, 2009.

- Law on “Need criteria”. 20 October 2015

- Law on “Subsistence minimum” 20 October 2015

- Law on “State Budget System” 22 July 2002

- Law on “State Budget of the Republic od Azerbaijan for 2016”

- Law on “State Budget of the Republic od Azerbaijan for 2015”

- Law on “State Budget of the Republic od Azerbaijan for 2014”

- Law on “State Budget of the Republic od Azerbaijan for 2013”

- Mullen JC. Oil Prices: Fundamentals, Fluctuations and Impacts. Hauppauge, N.Y: Nova Science Publishers; 2012.

- Ministry of Finance . “Budget Guide of a Citizen” Baku . 2015

- Rules on the preparation and execution of the annual program of revenues and expenditures (budget) of the State Oil Fund of the Republic of Azerbaijan. 12 September 2001

- The Decree of the President of the Republic of Azerbaijan on the Execution of the Budget of the State Oil Fund of the Republic of Azerbaijan for 2014 (25.06.2015)

- The Decree of the President of the Republic of Azerbaijan on the Approval of the Budget of the State Oil Fund of the Republic of Azerbaijan for 2015 (21.01.2015)

- The Decree of the President of the Republic of Azerbaijan on the Execution of the Budget of the State Oil Fund of the Republic of Azerbaijan for 2013 (22.05.2014)

- World Bank Data – Russia overview

- World Bank Country Snapshot – Azerbaijan, 2015

[1] http://www.state.gov/e/eb/ifd/

[2] http://www.maliyye.gov.az/node/7

[3] http://www.maliyye.gov.az/node/7

[4] The law on “Budget System” 2 July, 2002

[5] The law on “Budget System” 2 July, 2002

[6] Ministry of Finance . “Budget Guide of a Citizen” . 2015

[7] http://www.nbim.no/en/the-fund/

[8] http://www.senzanubi.it/home/norges-bank-vende-azioni-unicredit-finmeccanica-mps-ed-sts/

[9] CESD Azerbaijani State Budget in 2016 Perspectives and Challenges. 2015.

[10] http://www.thelocal.no/20150819/norway-oil-fund-sees-first-quarterly-fall-in-three-years

[11] CESD Azerbaijani State Budget in 2016 Perspectives and Challenges. 2015.

[12] http://www.cnbc.com/2015/10/27/russias-reserve-fund-could-run-empty-in-2016.html

[13] http://www.cnbc.com/2015/10/27/russias-reserve-fund-could-run-empty-in-2016.html

[14] http://www.ibtimes.com/russia-running-out-money-finance-minister-says-reserve-fund-could-be-drained-2016-2158349

[15] http://tass.ru/en/economy/831989

[16] http://data.worldbank.org/country/russian-federation#cp_wdi

[17] http://www.oilfund.az/en_US/about_found/meqsed-ve-felsefe.asp

[18] http://progrep.eiti.org/2015/glance/importance-natural-resources-government-revenues

[19] Ministry of Finance. “Budget guide of a citizen” Baku, 2015.

[20] http://www.infomine.com/investment/metal-prices/crude-oil/5-year/

[22] http://www.oilfund.az/az_AZ/huequqi-senedler/fondun-buedcesine-dair/azerbaycan-respublikasi-doevlet-neft-fondunun-2013-cue-il-buedcesinin-icrasi-haqqinda-azerbaycan-respublikasi-prezidentinin-serencami-22-05-2014.asp

[23] The analysis of Oil fund budgets for 2014 and 2015. www.oilfund.az

[24] http://www.maliyye.gov.az/sites/default/files/2016_budce_teqdimati.pdf

[25] Ministry of Finance . “Budget Guide of a Citizen” Baku . 2015

[26] Law on “State Budget of the Republic of Azerbaijan for 2014”

[27] As there is no report for November and December of 2015, I compared only first ten months of three years.

[28] http://www.maliyye.gov.az/node/1867

[29] Law on “State Budget of the Republic of Azerbaijan” for 2014

[30] http://www.maliyye.gov.az/en/node/1865

[31] http://www.cbar.az/other/azn-evolution-chart/

[32] http://www.stat.gov.az/source/budget_households/

[33] http://customs.gov.az/files/201410.pdf

[34] I took 1$=1.05 AZN after devaluation and 1$=0.78AZN before devaluation in all calculations.

[35] http://www.worldbank.org/content/dam/Worldbank/document/Azerbaijan-Snapshot.pdf

Oval Useful news from Azerbaijan and Caucasus

Oval Useful news from Azerbaijan and Caucasus