Obtaining independence on November 18, 1991, the Republic of Azerbaijan entered a long lasting1 transition period with different stages, which lasted till 2010. During this period, the economic development of the country experienced several cycles: firstly, the recession (19921995) recovery (1996-

1997), boom (1998-2008) and final slump (starting 2009).

Nevertheless, despite all the above-mentioned, the average growth rate of the economy of Azerbaijan during the 20 years since the country restored its independence has been characterised with positive results particularly due to the rapid growth in the second decade. In 2008, the GDP production in Azerbaijan was twice more than that of 1990. According to the results of 2010, Azerbaijan was ranked the 72th country of the world for of the GDP with a national income of USD 54.37bln2.

Analysis and assessment of the lost opportunities and lessons learnt over the last 20 years indicate that the efficiency of resource utilization in replacing quantity indicators by quality indicators was not adequately efficient. Thus, the rupture of traditional economic relations at the beginning of 90s, e.g. after the collapse of the Soviet Union on the one hand and the war with Armenia and the occupation of Nagorno-Karabakh and adjacent regions to it by Armenia on the other hand might be considered as decisive objective factors causing decline or regress of the economy in the initial years of independence.

Nevertheless, alongside with this, the delay of economic transformation reforms due to various reasons, including the pending liberalization of prices and de-nationalization measures in comparison to other post-soviet countries prolonged the period of transformation of Azerbaijan’s economy from regress to revival. For this reason, the first decade of independence is memorized as the exit from the crisis with reform initiatives to ensure transition from one economic system into another.

Afterwards, starting from the middle of the second decade of independence, increasing oil revenues caused a delay in existing reform initiatives by setting at rest the government, which slowed down the liberalization efforts and set back the course of establishing institutions envisaged for ensuring the sustainability of the economic growth.

In parallel, during the period of re-obtaining its independence, Azerbaijan became a member of authoritative financial and political organizations such as World Bank, International Monetary Fund, European Bank for Reconstruction and Development, Islamic Development Bank, World Customs Committee. It also joined the European Neighbourhood Policy and the Eastern Partnership Program.

Regress stage of the economy (1992-1995)

An assessment of the economy of the passed 20 years according to the stages shows that high inflation rates were one of the considerable features of the 1st stage (1992-1995). During thisperiod, particularly the change in purchasing power and shortage in the consumer markets The fact that launching national currency also coincided with the same period led to the rapid devaluation of the manat due to increasing inflation. Another feature memorising this period was related to serious problems in the financial and banking systems, including creation and collapse of pyramids. As a result, these processes stimulated inflation on one hand and loss of confidence to the financial and banking systems on the other hand. For this reason, the application of monetary regulation instruments has allowed to stabilize the value of manat since 1994 and restrain inflation since 1996. Hence, later on the more severe nature of the pursued monetary policy led to the creation of deflation in the economy in 1998 and 1999.

In the first stage, delays, taking place especially due to political reasons in undertaking the measures directed towards creation of the legislative framework for preparation of the privatization3, particularly adoption of the privatization program4 created conditions for plundering and sale of the existing state property by so called “red directors5” as a result of poor management of the state property. Existing scarcities in investment opportunities and as a result, reduction of the production capacity of factories and plants year by year worsened the social situation due to unemployment and intensified labour migration.

Despite all of these challenges, signing of the first Production Sharing Agreement for exploration of the Azeri-Chirag-Guneshli6 oil-field with high long-term perspectives on September 20, 1994 created grounds for the economic revival through the change of the political situation. This Agreement served as a basis for influx of the incredible amount of foreign investments into the Azerbaijan’s economy, particularly to the oil sector. Let us have a look to the macroeconomic indicators better characterizing that period.

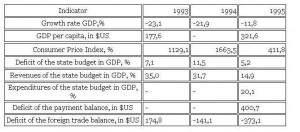

Main socio-economic indicators of Azerbaijan in 1993-95 Table 1.

Source: Central Bank of the Republic of Azerbaijan, Ministry of Finance of the Republic of Azerbaijan and State Statistical Committee of the Republic of Azerbaijan

As a conclusion of this stage it might be noted that the establishment of a number of institutions to support economic reforms, particularly multi-type property and competition also coincided with this period. Thus, the State Committees for Anti-monopoly policy and Entrepreneurship and on Land Issues and Property Management were established in 1992. Despite the political and military challenges, generally this period . was significant from the viewpoint of the establishment of new institutions and transition into market economy, including launching of the manat in 1992.

Nevertheless, objective difficulties of the transition period (more characterising this period), additional expenditures created by the state of war, and break of the traditional economic relations characterized a number of macro-economic indicators of that period with negative sign. Alongside with this, signing of the Production Sharing Agreement, which is considered to be the most important political event of the first stage of the modern economic development history, played a significant role in attracting investments into the economy of Azerbaijan and GDP growth during the later stages.

Revival period of the economy (1996-1998)

Second stage of the modern economy of Azerbaijan differs from others due to quality indicators and reform initiatives. During this period, national economy mainly had the following 3 tasks to accomplish:

-To enhance private property by conducting structural reforms in property;

-To accelerate the transition period by building market institutions;

-To attract foreign investments, particularly by strengthening the mutual economiccooperation in the oil sector.

In order to implement the first task, privatization of the state property started in 1996. Thus, realization of the first State Program on privatization of the state property for 1995-1998 coincides with this period. Within this program it was planned to transfer 65% of the property, subject to de-nationalization, to the citizens of the country for free through realization of the privatization measures. Since application of this model, which theoretically seemed to be possible, required some more time, the second State Program adopted in 2000 started serving this purpose. Thus, the mass privatization process in Azerbaijan was extended and took 14 years which has no analogue in the world. Validity of the privatization vouchers issued during this period expired in January 2011. Even though privatization policy started at this period couldpartially solve problems caused by political changes, such as application of market principles into the economy and involving the wide group of population into the economic transformation process, it could not achieve such economic objectives as creation of efficient private sector by establishing the effective managers’ institute and fiscal objectives as financial inflows from the sale of privatized property into the public budget. Thus, even though the share of the private sector in GDP increased from 25% in 1996 up to 52% in 1998, namely due to the multiple mistakes made in the privatization process it was not possible to build efficient economic and management system in this sector. The reason for this was the fact that the political approach as a simple measure conditioning the change of property in regard of the privatization prevailed over the economic approach covering the period starting since the sale of the state property till its normalization (ensuring its (state property’s) efficient/profitable operations) and implemented within a system.

This period also was the beginning of the land reform in Azerbaijan. Thus, adoption of more than 52 decrees, laws and other regulations, including the Law of the Republic of Azerbaijan “On Land Reform” dated July 16 1996; the Law of the Republic of Azerbaijan “On State Land Cadastre, monitoring of lands and mapping” dated December 22 1998; Law of the Republic of Azerbaijan “On Rent of Land” dated March 12 1999; “Land Code of the Republic of Azerbaijan” adopted upon the Law of the Republic of Azerbaijan dated June 25, 1999; the Law of the Republic of Azerbaijan “On Land Market” dated May 7, 1999 during this period created a significant base for implementation of the land reforms in the country.

This period might also be characterized with the completion of the first stage of the land reforms in Azerbaijan. For the first time within CIS area, 2042 productive (fertile) lands, which were the land state (collective) property, were distributed among population for free. Thus, 3.5 mln persons or 874 thousand households received free lands and turned them into their private property. 3 main types of property were considered in implementation of the land reforms. As a result, 56% (or 5.9mln ha) of total 8.6mln ha of lands became state property; 23.5% (or 2.32mln ha) municipal property and 19.6% (or 1.7mln ha) private property. Thus, the key quality characteristic of the realization of the first and second tasks of this period was transformation of property relations.

During this period, the Oil Contract signed on September 20, 1994 and adoption of the Law “On Protection of Foreign Investments” in 1995 played a decisive role in accomplishment of the task of involving foreign investments into the national economy by intensifying mutual economic cooperation.

Thus, namely due to the signing the above-mentioned contract, foreign investments allocated in the economy of the country reached USD 375.1 mln. in 1995, USD 620.5 mln. in 1996, USD1307.3 mln. in 1997, and USD 1472,0 mln. in 1998. As a result, the foreign investments made to the economy increased by 3.8 times in 1998 as to 1995. At the same time, at this stage Azerbaijan applied for the membership of the World Trade Organization. Hence, despite 15 years have passed since that time, Azerbaijan still remains the only Southern Caucasian country which is not the member of this organization.

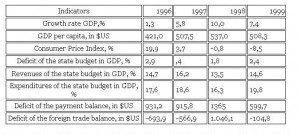

The key macroeconomic indicators characterizing the revival period of the economy of Azerbaijan in this period are shown in the Table below:

Main socio-economic indicator of Azerbaijan in 1996-99 Table 2.

Source: Central Bank of the Republic of Azerbaijan, Ministry of Finance of the Republic of Azerbaijan and State Statistical Committee of the Republic of Azerbaijan

While analyzing the above table, we can see that this period was also marked with the completion of 1998 with the positive foreign trade balance alongside with the continued growth of GDP, rapid drop of inflation down to one digit level and beginning of deflation, normalization of the budget deficit and increase in positive side of the balance of payments.

Progress stage of the economy (2000-2008)

Considering the past 20 years one can describe this period as a long and interesting one in the history of Azerbaijan’s modern economy characterising the last 10 years with progress. This period continued till the global financial crisis. During this period, the share of the private sector in the economy of the country raised up to 84.5% exceeding 70% limit. At the same time, in this period serious increases were observed in the attraction of the foreign investments into the national economy. Thus, the volume of the foreign investments reached AZN 967.8 mln. in 2000, AZN1.2 bln 2001, AZN2,2 bln in 2002, AZN3.8 bln. in 2003, AZN4.9bln. in 2004, AZN5.8bln. in 2005 and foreign investments increased by 22.2 times in 2005 as to 1995.

Key event of this period was the increase of oil production and exports in Azerbaijan and creation of the infrastructure for the delivery of oil to world markets. Thus, the first oil was delivered to Ceyhan through the Baku-Tbilisi-Ceyhan main oil export pipeline, foundation of which was laid in 2003, and starting namely since that time rapid changes were observed in growth indicators of the Azerbaijan’s economy. In parallel with the GDP increase, significant changes were observed also in the growth of the budgetary revenues. During those years, enhancement of the investment policy, particularly due to increases in budget revenues caused significant changes in the structure of the GDP. This period, introducing the high growth rates to Azerbaijan’s economy, also created risks in a long run. The most important risk was related to the efficient and transparent management of oil revenues.

Recognizing the necessity of establishing an independent welfare fund, The Government of Azerbaijan made a decision at the end of 1999 to establish the State Oil Fund; it was evenbefore the oil revenues started entering into the economy. Thus, the centralization of oil revenues changed both quality and quantity characteristics of this period. As a result of this, soon the government of Azerbaijan started using two sources for spending. Even though the first budget of the Fund approved for 2001 reflected only expenses, in 2002 the fund had revenues and expenses as well and starting since 2003 transfers were started to be made from the Fund into the state budget. Thus, expenditures from both the state budget and the State Oil Fund sharply increased the public investments as a whole. Certain programs and strategies were approved during this period with the purpose of increasing efficiency of oil revenues’ management and allocation of investments. Thus, the “State Program for Poverty Reduction and Economic Development of the Republic of Azerbaijan (2003-2005)” and the “State Program for Social-Economic Development of the regions of the Republic of Azerbaijan (2004-2008)”, as well as the “Long-term Strategy for management of oil and gas revenues” which was adopted in 2004 were approved for implementation of the state policy in this direction.

Nevertheless, despite the existing problems in the field of the implementation of these programs ensured quantity changes in investments allocations, they could not provide quality characteristics to this process as a whole. As a result, the process of establishing the necessary market institutions for the sustainable economic development was moved to the secondary plan during this period. Close to the end of this period start of the operations of the BTC and rapid increase of the oil prices in the world market changed the socio-economic situation considerably. Under the impact of the first oil boom (2006-2008) the investment expenditures started increasing rapidly. Thus, the following sectors as utility services, power and transport (investments were mainly directed to this area), public administration, education and defence mostly benefited from fiscal expansion policy implemented by the government during this period. During the past period the main portion of the current expenditures was directed towards public administration and education. Investments budget which mostly benefited from rapid expenditure growth increased by 5,4, 2,2 and 2,3 times during 2006, 2007 and 2008 respectively in comparison with the previous years; drop in this expenditure item was observed only in 2009.

Even though the efficiency of the investment projects that were implemented with the lack of transparency and accountability, under the poor state financial supervision and public oversight and the cost of whish was exaggerated year by year, these allocations played a crucial role in rehabilitation of the transport and social infrastructure system.

Nevertheless, the expansion of the expenditures in line with the increase of the oil revenues under the lack of effective cost management and liberal economy, spending “easy” money in non-productive sectors without observing any principles of responsibility, result-orientation, efficiency, and transparency created conditions for the increased scale of corruption as one of the serious problems for the development of the national economy and welfare and speedy inflation. All the above mentioned increases expenditures of the population, devalues their revenues and distorts the general welfare indicators. The macro-economic situation of this period might be described with the Table below.

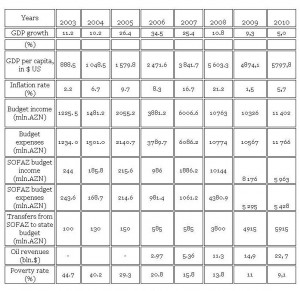

Main economic indicators related to oil wealth in Azerbaijan Table 3.

Source: Central Bank of the Republic of Azerbaijan, Ministry of Finance of the Republic of Azerbaijan and State Statistical Committee of the Republic of Azerbaijan

As it is shown in the table, during this period the increase of the 2 digit growth rate, which started from 2000, reached the peak level in 2005-2007. As a result, during 2003-2010 real GDP in Azerbaijan increased by 3 times; foreign trade turnover by 5.4 times; and strategic foreign currency resources by 19 times and reached USD 34.2 bln in the first quarter of 2011. Average monthly salary in Azerbaijan for that period was USD 430, whereas Russia left behind this level of average monthly salary in 2006 and Kazakhstan in 2007. It is possible to observe the same problems also in the healthcare sector. In 2011 the share of the allocations from the state budget to this sector which lags behind others due to the speed and the scope of application of reforms, comprised 4.3% in the expenditure part of it and 1% in the GDP. Whereas in Central and Eastern European countries even back in 2007 healthcare expenses comprised 3.1% of the GDP in Latvia, 3.9% in Lithuania and Estonia, 6.5% in Czech Republic, 6.4% in Hungary, 7.4% in Slovenia, 4.8% in Slovakia, 3.8% in Poland and Romania, and 4.5% in Bulgaria. Apparently, the inefficient use of the increasing oil revenues by the Government of Azerbaijan remains as one of the main impediments preventing population from benefiting from social-economic achievements.

Development of the national economy goes through the acceleration of the integration into Europe and European political, economic and social institutions. With this regard, active participation of Azerbaijan in the expansion policy of Europe through the Eastern PartnershipProgram, to which Azerbaijan is a party, and application of the European social standards are the key objectives to be accomplished.

Stagnation stage of the economy (2011 and ….)

The driving force of the economic growth observed in Azerbaijan during recent years is the fiscal expansion policy carried out thanks to the increasing of oil revenues. According to the calculations, the oil sector comprised 44.6% of the GDP in 2010; income from this sector comprised 63% of the budget revenues and export of crude oil and oil products comprised 92.9% of overall exports. All of these prove that economy of Azerbaijan is expanding due to the oil resources. Global practice shows that, one of the important features characterising the economies of the countries having rich natural resources is the fact that economic growth rate slows down gradually (by the time passes). Such trend is also underscored as one of main negative symptoms in the resource-curse concept. The recent slowdown of the growth rate in the Azerbaijan’s economy heralds the beginning of such trend. Thus, decline is observed the dynamics of the real economic growth rate in Azerbaijan over the last few years including 2010. The table below helps to observe this trend clearer.

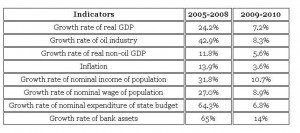

Macroeconomic trends in 2005-2010 yy Table 4.

Source: Central Bank of the Republic of Azerbaijan, Ministry of Finance of the Republic of Azerbaijan and State Statistic Committee of the Republic of Azerbaijan

As is seen from the Table, decline of the growth rates over the last 2 years might be explained with 3 reasons: slackening of the GDP growth in the oil sector due to the decrease of the oil production and oil prices; negative impacts caused by the global financial crisis on total demand and credit markets; baseline effect (since the GDP grows every year over the bigger baseline, the same growth is resulted in the lower percent growth). According to the forecasts, during 2011-2015 low rate economic growth will be observed in the country. Based on the IMF (International Monetary Fund) report for May 2010, the average economic growth rate in Azerbaijan will be 3% in 2011, while the growth of the non-oil sector 4.9%. According to the latest forecasts, average annual growth rate will be 2.65% during 2011-2012. Presumably, low growth rates will lead to decline of investments, budget expenditures and revenues of the population. This creates a new reality for the fiscal and monetary policy.

Conclusion

Calculations show that in comparison with the period of the restoration of independence, in the course of the last 20 years physical volume index of Azerbaijan’s economy increased averagely up to 4 times. It is very important to identify the factors causing this growth and their sources.8 According to the calculations of the IMF9, during 1996-2006 the following shares were observed in the average growth rate (11.4%) in Azerbaijan; capital – 7.1%, labour – 0.2%, and technological productivity factor – 4.1%. Apparently, the economic growth rate due to the accumulation of the capital was much higher in Azerbaijan. As to the previous years, this trend was even stronger during 2006-2010. On the other hand, the labour productivity and contribution of the labour factor to the economy are also considered as important factors while analysing the sources of the economic growth. As it has been noted in the latest country memorandum of the World Bank, “the existing problems led to low productivity in Azerbaijan in comparison to a number of neighbouring countries, particularly, certain growth of the overall productivity of the economy recorded in recent years is mostly explained with the growth of the oil sector. Quite opposite, productivity growth of the agricultural sector is almost in the level of zero. Agriculture mainly suffered from the lack of investments which was reflected in drop of the per capita capital. But it should also be noted that, even though the growth of the services sector in Azerbaijan was higher, the total productivity level of the country was extremely lower in comparison to neighbouring countries like Georgia and Kazakhstan”10.

The retrospective analysis of the recent 20 years of the history of Azerbaijan’s economy shows that unless economic reforms and transformation processes are intensified and economic liberalization and diversification are ensured, the sustainability of the achievements gained in the economic sphere creates serious doubts. Studies of the IMF experts, conducted due to this concern created several years ago, show that the volume of the real GDP in Azerbaijan might be lower by 20% than the level of 2010, because only the first two out of 4 key reasons11 necessary for development of the country (luck and multiple equilibrium (1), geography (2), institutions (3), culture (4)) completely exist in Azerbaijan. Incompleteness of the last two reasons negatively impacts sustainability of the existing growth and development.

Indeed rich natural resources and favourable geographical position of Azerbaijan played a significant role in achieving positive results during the last 20 years. Institutional lag in the economy due to delay of reforms in establishment of a free market system, liberalization and centralization of the economy, transparency of the governance and creation of e-governance, aswell as support to economic competitiveness, immunity of property, formation of the civil society, and the culture of the performance of the independent judiciary and legal system raise many questions regarding the sustainable and balanced (inclusive) economic development in Azerbaijan in the forthcoming years.

For this reason, it is extremely important to increase the norm of the real internal savings in order to achieve sustainable economic growth in Azerbaijan, the economy of which (exports, fiscal revenues and GDP) depends on natural resources. Liquid foreign currency reserves accumulated at the result of oil and gas exports mostly show themselves as foreign savings factor and do not ensure the “investment-savings” balance considered important for the economy of Azerbaijan and being in high demand domestically. Ensuring “investment-savings” balance goes through the increase of the domestic savings potential of the economy and support provided to it by the favourable domestic investment environment. “Total savings” in Azerbaijan’s economy lags behind the actual latest consumption of the last few years. Latest consumption expenses of the population were equal to 43% of the GDP in 2010 in comparison to the respective period of 2009. This indicates that the larger part of the capital generated as a result of oil exports is spent on consumption and not for creation of new value.

Now one of key issues standing in front of us is to intensify the foreign investment inflow into the non-oil sector by improving entrepreneurship environment in the country and not to allow crow-out effect of the state investments to private ones.

To achieve this, first of all monopolies, artificial exaggeration of prices and groundless inspections by the state bodies are to be eliminated. Improvement of legislative acts regulating entrepreneurship activity, creation of industry zones and business incubators, development of small and medium entrepreneurship, and involvement of youth into entrepreneurship activities are necessary for this purpose. Equally it is necessary to support competitiveness, reduce and differentiate certain tax rates and further simplify customs procedures.

One of the conditions imperative to ensure sustainable growth and balanced economic development in short and medium term is to intensify transformation reforms of the economy. The dominant role of the government in provision of public goods and services and in regulation of several prices and tariffs12, as well as in exports13 and energy production requires considerable works to be done in these directions.

Considering the fact that increasing oil revenues play a special role in formation of the fiscal policy in Azerbaijan in a long term, it is possible to say that one of the priority tasks of the government is an optimal management of revenues. The experience of other countries facing the similar problem shows that there is no standard approach or recipe for its solution. For this reason, it is an extremely complex and significant task to determine adequate fiscal policy in the given circumstances.

On the one hand, the necessity of reconstruction of obsolete infrastructure serves political and social purposes, but it also bears economic significance due to its impact to reduce costs of businesses on the other hand. Nevertheless, both political and social purposes and economic-business effects require formation of framework for optimization of the public expenditures. Formation of such framework is essential for creation and amplification of additional effects.

Oval Useful news from Azerbaijan and Caucasus

Oval Useful news from Azerbaijan and Caucasus