5. The role of the municipal tax in the increasing the rationality of the activity of the local management organization

The rational activity of the local management depends on the level of the finance supply for them. The municipal tax forms the base of the finance source of the mu- nicipal. For the purpose of providing the stability of the municipal tax and repay- ment, the national leader Heydar Aliyev signed the Law of the Republic of Azerbaijan “On local tax and repayment” on April 7, 2002.

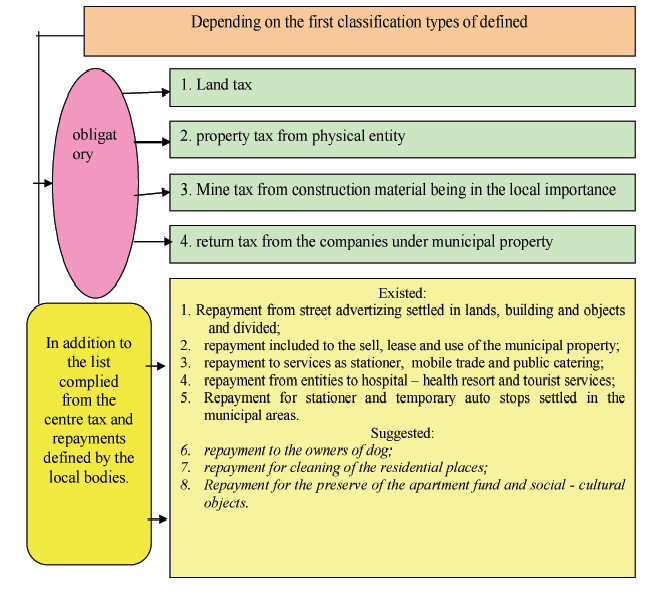

The following are included to municipal taxes in accordance with the Tax Code of Azerbaijan Republic [1] and the Law of the Republic of Azerbaijan on “Local tax and repayment” [6, 10, 13]:

- Land tax from the physical entity;

- Property tax from the physical entity;

- Mine tax on the construction material in local importance (brick-tile clay, con- struction sands, gravel stuffs possessing to higher steady);

- The return tax of the legal entities being under the municipal property.

In accordance with the law, the following are included to the local repayment:

- Settlement of the street advertizing in sands, buildings and other objects and repayment for their In accordance with the article 15 of Law of the Republic of Azerbaijan “on advertizing” repayments on street advertizing in lands, buildings and other objects being under the property of the municipalare transferred to the local budget. The spreading the advertizing is implemented according to the agreement with owner of the corresponding objects [8, 11].

- In accordance with legislation of the Republic of Azerbaijan repayment was included from privatization of the municipal property, execution and the The repayments made in accordance with agreement amongst municipal and other par- ties. The relations are regulated by the Law of Republic of Azerbaijan “On ma- nagement of the lands of Azerbaijan Republic”, the Tax Code of Republic of Azerbaijan and other legislative acts. In accordance with the Article 10 of Law, in the case of the sell of the lands under the property of the state and municipal, the lower limit of the lease fee of lands cannot be less than 2 copper. In the case of preva- lence of suggestion to agricultural lands being under its property to demand, and in the case of the lease of less injured and unfit lands the lease fee is applied by abate terms [7, 11].

- Repayment taken out of hotel, sanatorium – health resort and tourism services in the municipal In accordance with the Article 9 of the Law of the Republic of Azerbaijan “On local tax and repayment”, the term of inbeing nor more than cop- per of the finance unit defines the repayment during a day for each person. The amount of customs paid to the municipal budget for one person is 1 manat 10 gepik [6, 11].

- In accordance with specialized parking and municipals possessing to the phy- sical and legal entity in the municipal areas repayment for constant and temporary parking of all kind of transport in destinated The temporary finance unit on each vehicle for the parking is defined by the term of inbeing no more than 0,1 (10 gepik) [6, 11].

- Repayment for services as stationer, mobile trade kiosk, public catering in spe- cially allocated plat of land by

As is noted, the municipal tax and taxation form the base of the steady municipal finance base. Taxes and taxation mechanism is freely formed by the local authorized bodies and administration.

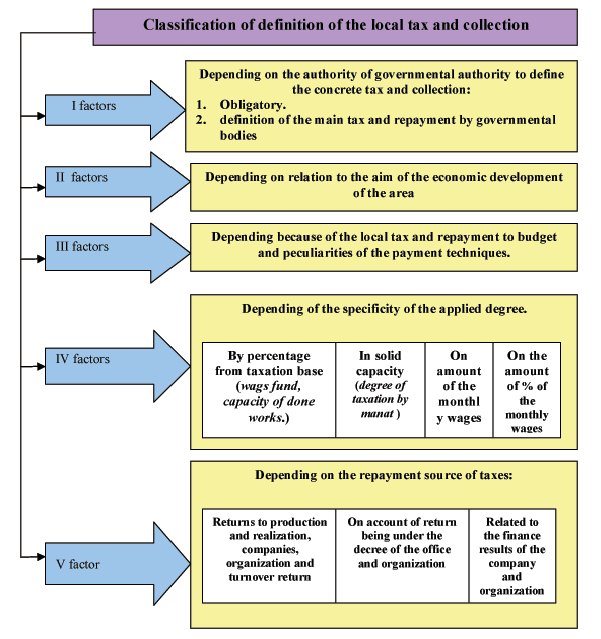

5 factors definition of the local tax and taxation depending on the authority of the

define the tax and collection of the State authority, relation of the area to economic development aim, account of the local tax and repayment to budget and peculiarities of the repayment techniques, specificity of the applied degrees and definition of local tax and collection depending on the repayment source classified in the Scheme 2.

The repayments applied by the local bodies and types of taxes defined by the legislation and in obligatory character, at the same time repayments that has to be paid displayed in the Scheme 2.

Tax and repayments mentioned Law of the Republic of Azerbaijan “On local tax and their repayment” does not serve the provide of the returns of local budgets so much. For the purpose of the development and strengthening of its economical base, it is necessary to make measures for increase of the current of tax and repayments to municipal budget.

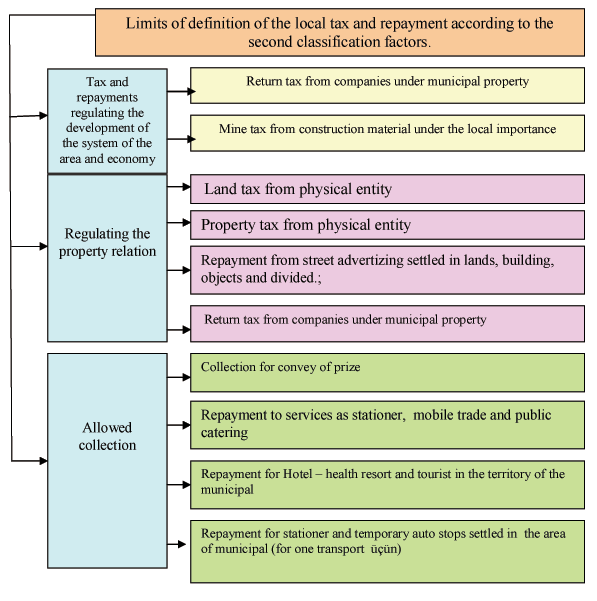

Limits of definition of the local tax and repayment depending of the relation of the economic development of the area are given in the Scheme 3. On the base of this classification, taxes regulating the development of the territorial-economic sys- tem, tax and repayment are regulating the property relations, at the same time taxes and collections having allowed peculiarities defined on the base of this classification.

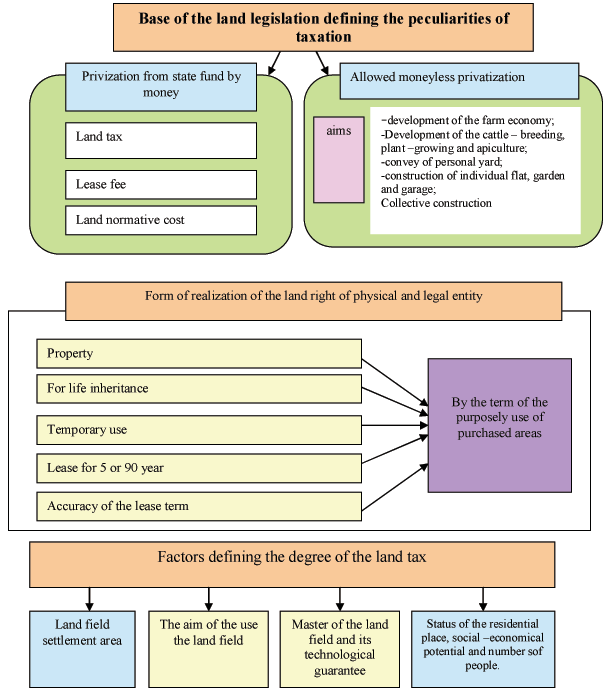

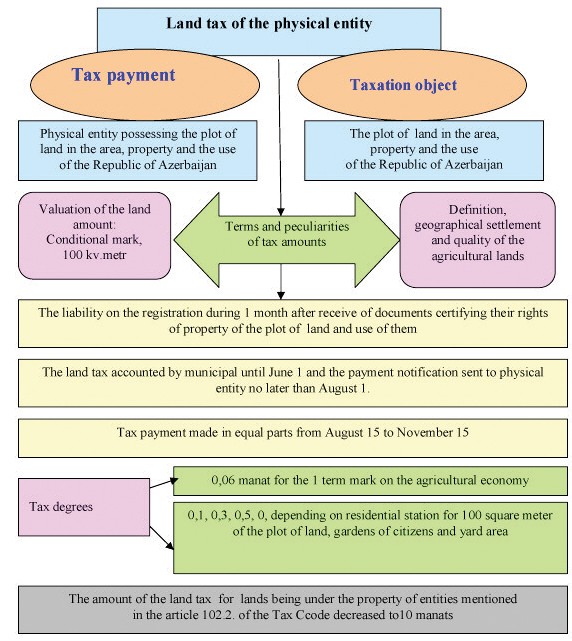

Taxation peculiarities have been defined and factors defining the tax degree depending of the plot of land, gardening field of citizens and yard fields of the resi- dential funds, at the same time form of realization of the land right of the physical and legal entities, industrial, transport, communication, trade-welfare services given in the Scheme 4.

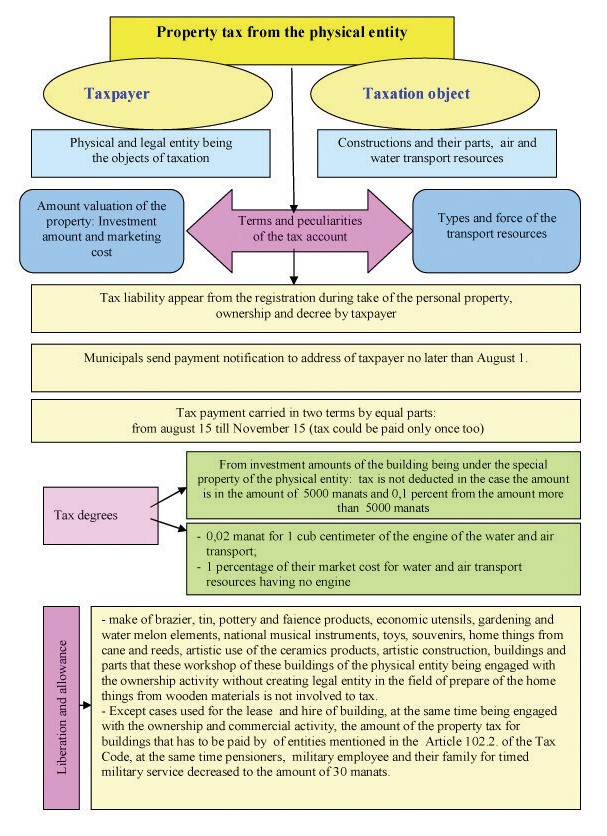

The rule of the form of the property and land tax of the physical entity given in the Scheme 5 and 6.Taxpayers and taxation objects defined, terms and peculiarities of tax account, registration of taxpayers, terms tax payments, tax degrees, allowance applied to this degrees found its reflection.

In general, the local finance resources divided into three general groups;

Resources of the other – budget funds of the municipal;

Finance resources of companies being under the property of the municipal;

The budget resources form the part of the finance of the municipal amongst the

finance resources. The local budget reflects the economic relation from economical point of view, cash resource possessing to the local governmental organizations on the base of it formed and used.

The existence of the real and absolute budget in the local self-management or- ganization, activate economic activity by increasing their economic independence, give possibility to develop infrastructure fields in attached areas, increase the economic potential and rationally use of them by increasing the finance resources. Finally, all them give opportunity comprehensively to meet the demands of peoples in areas of municipals.

The assessment of the income and expenditure carried out by standard factors while defining the local budget of municipals: the corresponding speed of divisions from state budget is taken in the current year, by the aim of cover the shortage of the local budget in previous year. This stimulate the activity of municipals, there is no differences amongst municipals working hard and weak. As a result, the shortage of the municipal is covered because of the state budget. The division society is relooked by the aim of stimulating the competition amongst municipal, the municipal organizations not being interested on formation of their local budget is differed from the self-managed organizations by their rationally activity.

The minimum expenses, if the local budget is defined on social and financial norms per capita by implying the return of the local budget. Because of the reason, the main direction of the budget plan is the definition of the next expenses of the local budget. For assessing the tax potential, it is necessary to make multi-variant accounts by using the special methodic. The assessment of the budget returns carried on account of the demands of the municipal budget organizations – according to nor- mative, not depending on the demands of people. Because of the reason, the returns of the municipals local expenses prevail their profits, grants and subsidiaries are al- located from the state budget by the aim of liquidation of shortage.

The structure of the municipal budget expenses form local communal flat eco- nomy, social expenses and profits directed to the state management. The expenses are not completely realized and municipals could ensure their financial situations by preserving aid from the center.

Therefore, there is need for improvement of the mechanism of regulation of the local budget from the centre. Otherwise the municipal organization depends on the state budget and executive organizations of the regions.

Oval Useful news from Azerbaijan and Caucasus

Oval Useful news from Azerbaijan and Caucasus